2026 New Year, New Vision!

Are you ready for 2026? Will you make the standard list of resolutions – all with the best of intentions to put yourself first? It’s tempting to...

2 min read

The Rochester Eye & Laser Team

:

Feb 9, 2026 8:00:00 AM

The Rochester Eye & Laser Team

:

Feb 9, 2026 8:00:00 AM

Opting to invest your tax refund in LASIK vision correction can be a game-changer for both your lifestyle and financial well-being. Discover why making a smart investment in your vision now can yield significant returns in the years to come.

Say goodbye to the ongoing costs of traditional vision correction methods like glasses or contacts. While LASIK may have a higher upfront cost, it eliminates the need for these recurring expenses.

The expenses of contacts and glasses can add up to $500 - $1,000 annually, or even more in some cases. Add in designer frames and specialized lenses, and the costs can skyrocket.

Long-Term Savings with LASIK: With the average cost of LASIK in Rochester, the procedure pays for itself within a few years compared to the continual expense of glasses or contacts.

For instance, a 25-year-old opting for LASIK could save a significant amount by the time they turn 50, without factoring in inflation or potential increases in traditional vision correction costs.

Enhanced Quality of Life:

LASIK not only brings financial benefits but also a remarkable improvement in your day-to-day life. Picture waking up with clear vision, engaging in outdoor activities without the hassle of glasses, or the discomfort of wearing contacts all day.

Investing in Yourself:

Choosing to invest your tax refund in LASIK is an investment in your well-being. It's a step towards eliminating daily hassles and enhancing your overall quality of life.

Moreover, investing your tax refund in LASIK can offer tax advantages for the following year. The IRS recognizes LASIK surgery as a deductible medical expense on your tax return, potentially reducing your taxable income if you itemize deductions.

Itemize Deductions: Opt for itemizing deductions on your tax return rather than taking the standard deduction.

Medical Expenses Threshold: Ensure your total medical expenses, including LASIK costs, exceed 7.5% of your adjusted gross income (AGI) to be eligible for the deduction.

Documentation and Receipts: Keep all receipts and documentation related to your LASIK procedure to support the deduction if requested by the IRS.

Investing your tax refund in LASIK vision correction is a smart financial move that offers both short-term and long-term benefits. By selecting a reputable provider like the Rochester Eye and Laser Center, you're not just investing in improved vision but also in a future free from the constraints and expenses of glasses and contacts.

Come to our next free LASIK Virtual Seminar and learn more about LASIK. Enter to win a Free LASIK procedure. . Must attend to be entered to win. Free LASIK Consultation available every day!

Are you ready for 2026? Will you make the standard list of resolutions – all with the best of intentions to put yourself first? It’s tempting to...

Are you looking for options when it comes to vision correction? Living with glasses and contact lenses doesn’t have to be the only way.

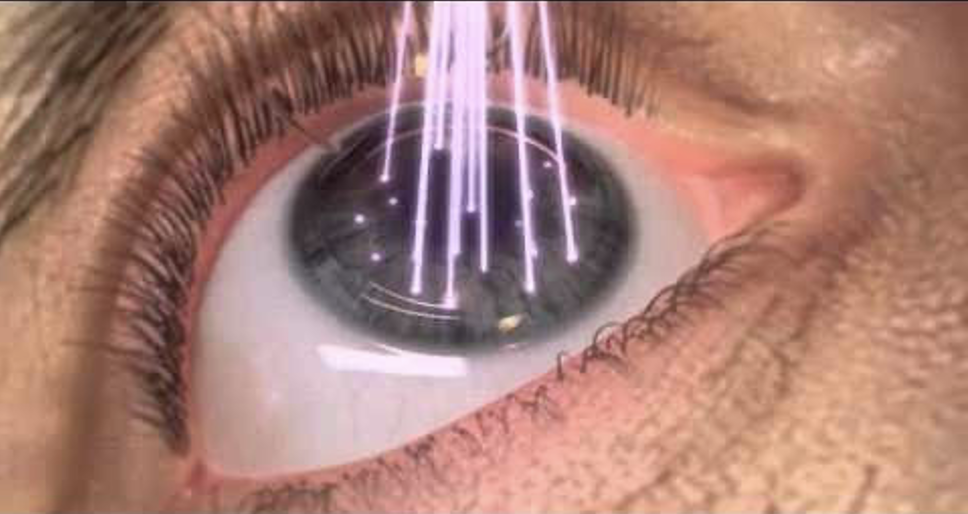

Considering LASIK surgery? Take the time to educate yourself by conducting thorough research and consulting with Dr. Lindahl, the esteemed LASIK...